In 2025, mastering MARI technical analysis is an essential skill for anyone looking to make informed investment decisions. As markets across the globe become increasingly interconnected, understanding the fundamentals, technicals, and market trends is key to navigating this complex landscape. Whether you’re an experienced investor or a beginner looking to sharpen your skills, this comprehensive guide will provide you with valuable insights into MARI technical analysis. By focusing on the unique aspects of MARI and how it fits into the broader financial environment, you will be better equipped to leverage this knowledge for financial success.

Understanding MARI: The Fundamentals

Before diving into the technical analysis, it is crucial to grasp the fundamentals of MARI. MARI, an acronym for Market Analysis and Research Indexes, represents a suite of financial tools used by investors to assess the performance and potential of various markets. It encompasses several key aspects, including market data, economic indicators, and company performance metrics. Understanding these fundamentals provides a solid foundation for any technical analysis.

- Market Data: MARI provides comprehensive market data, including historical prices, volume, and trading patterns. This data is essential for identifying trends and making informed predictions.

- Economic Indicators: With a focus on macroeconomic trends, MARI includes reports on GDP growth, inflation rates, and employment figures. These indicators help investors understand the broader economic context impacting the markets.

- Company Performance: Evaluating individual companies’ performance is crucial. MARI tracks earnings, revenue growth, and other financial metrics, enabling investors to make informed decisions about specific stocks.

Technical Analysis: Decoding MARI Charts

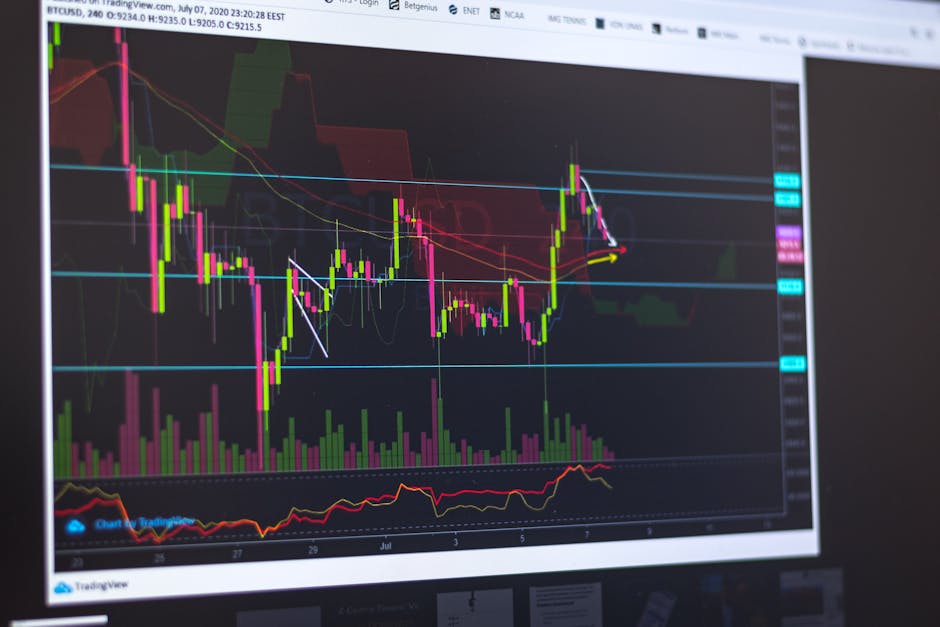

Once you’ve grasped the fundamentals, the next step is to dive into the technical analysis of MARI. This involves examining charts and patterns to predict future movements. Here are some key techniques used in MARI technical analysis:

Identifying Trends

One of the primary goals of technical analysis is to identify trends in the market. Trends can be upward, downward, or sideways, and recognizing these patterns allows investors to align their strategies accordingly.

- Moving Averages: Moving averages are a simple yet powerful tool to identify trends. By smoothing out price data, they help investors spot long-term trends and potential reversals.

- Trendlines: Drawing trendlines on MARI charts helps visually confirm the direction of a trend. Breakouts above or below these lines can signal potential changes in trend direction.

Utilizing Indicators

Technical indicators provide additional insights into market behavior. MARI offers a range of indicators to enhance your analysis:

- Relative Strength Index (RSI): RSI measures the speed and change of price movements. It’s a valuable tool for identifying overbought or oversold conditions, helping investors decide entry and exit points.

- Bollinger Bands: These bands provide a visual representation of price volatility. When prices touch or move beyond the bands, it may indicate a potential trend reversal or continuation.

Market Trends in 2025

As we look at the financial landscape in 2025, several key market trends are shaping MARI technical analysis:

- Technological Advancements: The integration of technology in trading continues to evolve. With high-frequency trading and algorithmic strategies becoming more prevalent, staying updated with technological trends is crucial.

- Sustainability and ESG Investing: Environmental, Social, and Governance (ESG) factors are increasingly influencing investment decisions. MARI now includes ESG metrics, allowing investors to align their portfolios with sustainable practices.

- Global Economic Shifts: With ongoing geopolitical tensions and economic shifts, understanding macroeconomic trends is vital. MARI provides insights into these shifts, helping investors navigate the global market landscape.

Navigating MARI for Successful Investments

With a solid understanding of MARI fundamentals, technical analysis, and market trends, investors can strategically navigate the complex financial environment of 2025. Here are some tips to maximize your success:

- Continuous Learning: The financial market is dynamic, and continuous learning is essential. Stay informed about new tools, indicators, and strategies to enhance your MARI analysis skills.

- Diversification: Diversification remains a key principle of successful investing. Utilize MARI to identify opportunities across different sectors and regions, minimizing risk.

- Risk Management: Implementing effective risk management strategies is essential. Use MARI to assess risk levels and adjust your portfolio accordingly.

FAQ

What is MARI in finance?

MARI stands for Market Analysis and Research Indexes, a suite of tools used by investors to analyze financial markets, including economic indicators and company performance metrics.

How can MARI help with investment decisions?

MARI provides valuable insights into market trends, enabling investors to make informed decisions by analyzing historical data, economic indicators, and company performance.

What are the key components of MARI technical analysis?

Technical analysis in MARI involves identifying trends, utilizing indicators like RSI and Bollinger Bands, and analyzing chart patterns to predict future market movements.

How is the global economic landscape in 2025 affecting MARI?

The global economic landscape in 2025, influenced by technological advancements and ESG investing, shapes MARI by incorporating these factors into market analysis tools.

Conclusion

Mastering MARI technical analysis in 2025 is an invaluable skill for investors seeking financial success. By understanding the fundamentals, analyzing technical indicators, and staying attuned to market trends, you can make informed investment decisions. As the global financial landscape continues to evolve, leveraging the insights gained from MARI will empower you to navigate the complexities of the market with confidence and precision. Stay informed, diversify your portfolio, and implement effective risk management strategies to achieve your financial goals in this dynamic environment.